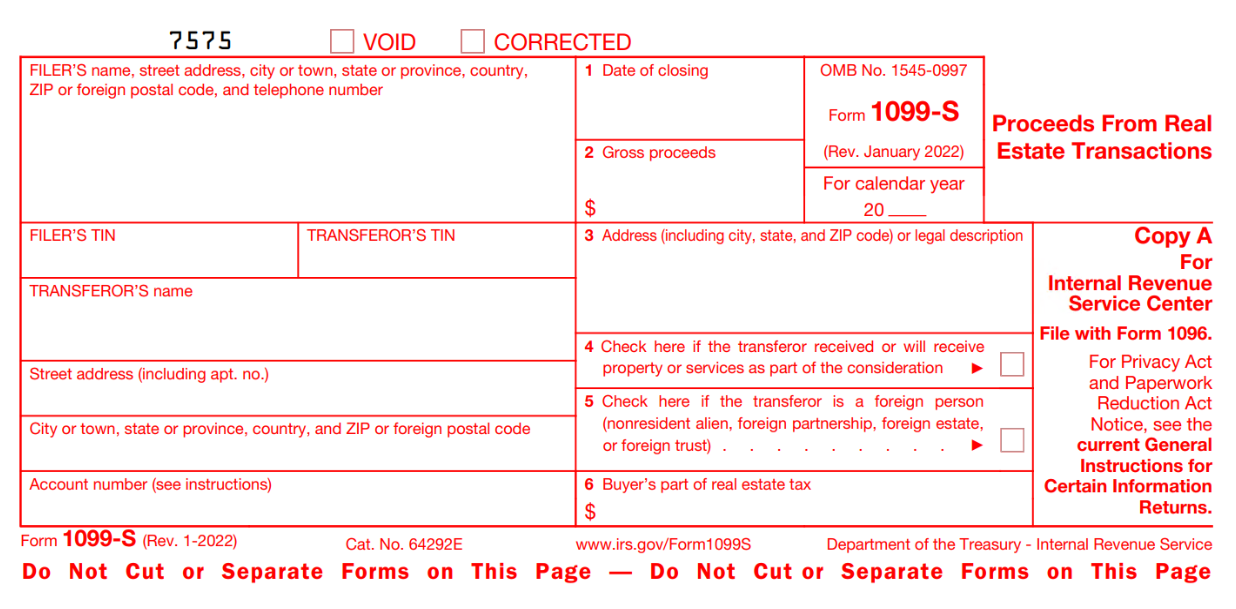

1099-S Form 2024

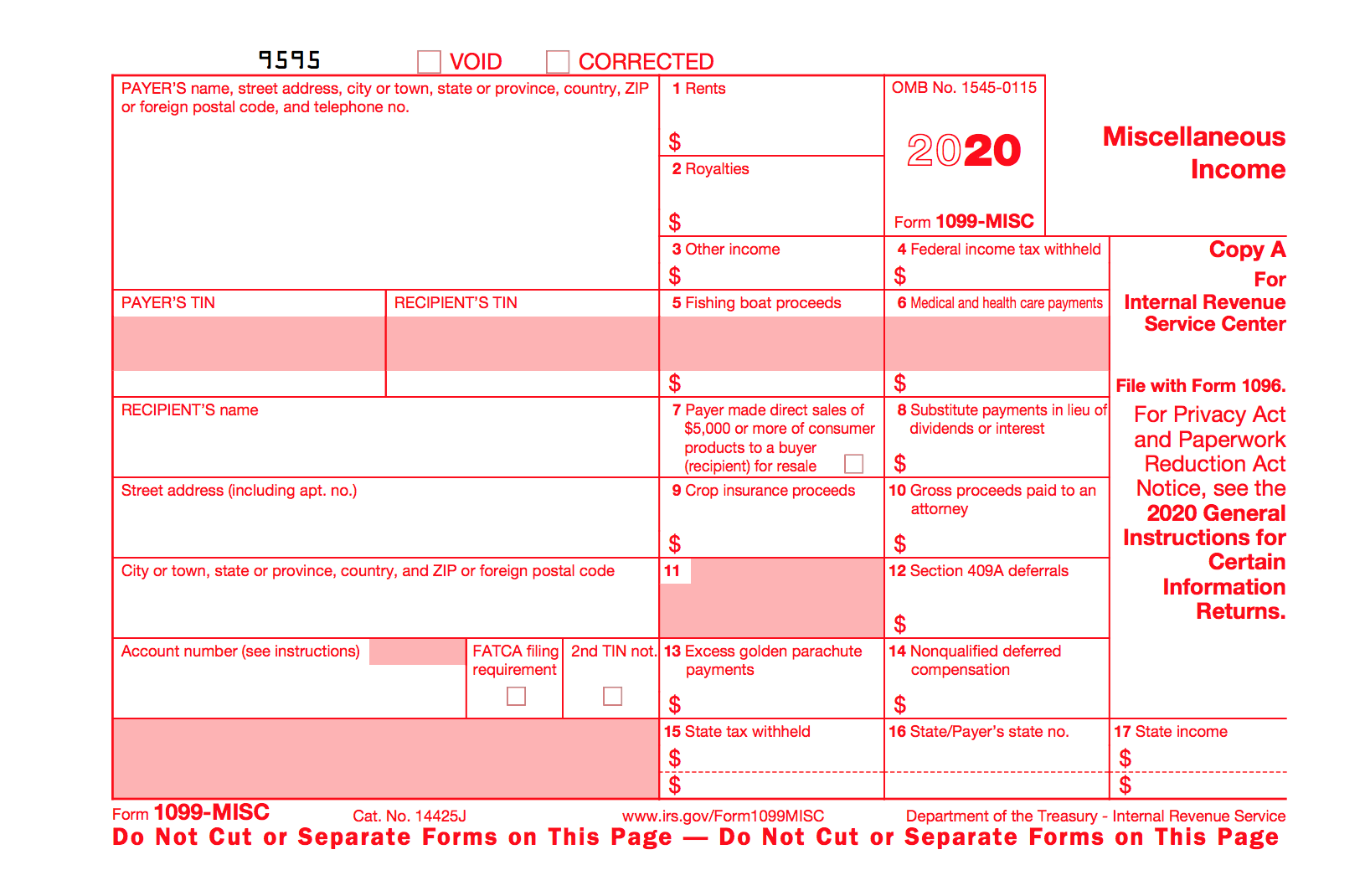

1099-S Form 2024. Form 1099 reports freelance payments, income from investments, retirement accounts, social security benefits and government payments, withdrawals from 529 college savings plans and health savings. If you sold your main home.

The irs is planning a threshold of $5,000 for tax year 2024. If mailed, the form must be postmarked by.

Key Dates For Filing 1099S In 2024.

The irs is planning a threshold of $5,000 for tax year 2024.

In Response To Input From Payment.

Sign in to turbotax and select pick up where you left off.

If You Use Paper 1099S, You Must Then File Another Information Return, Form 1096, To Transmit The 1099.

Images References :

Source: wiki.1099pro.com

Source: wiki.1099pro.com

1099S 2022 Public Documents 1099 Pro Wiki, In response to input from payment. The irs is planning a threshold of $5,000 for tax year 2024.

Source: www.contrapositionmagazine.com

Source: www.contrapositionmagazine.com

Fillable Form 1099 Nec Form Resume Examples o7Y3LqkVBN, This form reports proceeds from broker and barter exchange transactions, such as sales of stocks,. In response to input from payment.

Source: marilinwmaye.pages.dev

Source: marilinwmaye.pages.dev

1099 Extension Form 2024 Daria Xaviera, Select search, enter sale of home,. Typically issued by the person or entity responsible for closing the transaction, such as a title company.

Source: printableformsfree.com

Source: printableformsfree.com

Form Fillable 1099 Printable Forms Free Online, Complete 4419 at the irs website: This form reports proceeds from broker and barter exchange transactions, such as sales of stocks,.

Source: www.schwabmoneywise.com

Source: www.schwabmoneywise.com

Schwab MoneyWise Understanding Form 1099, In addition to filing with the irs, a recipient copy must be. If you sold your main home.

Source: singletrackaccounting.com

Source: singletrackaccounting.com

What Are 1099s and Do I Need to File Them? Singletrack Accounting, This form is used to report dividend income from stocks or mutual funds. Complete 4419 at the irs website:

Source: printableformsfree.com

Source: printableformsfree.com

Free Printable 1099 Tax Form Printable Forms Free Online, If you use paper 1099s, you must then file another information return, form 1096, to transmit the 1099. In addition to filing with the irs, a recipient copy must be.

Source: www.contrapositionmagazine.com

Source: www.contrapositionmagazine.com

Fillable Form 1099 S Form Resume Examples v19xKBO27E, For the 2024 tax year, the irs has set out specific 1099 reporting requirements. The deadline for distributing 1099s to vendors is jan.

Source: printable.conaresvirtual.edu.sv

Source: printable.conaresvirtual.edu.sv

Free 1099 Tax Forms Printable, This form is used to report dividend income from stocks or mutual funds. Typically issued by the person or entity responsible for closing the transaction, such as a title company.

Source: printableformsfree.com

Source: printableformsfree.com

Free Printable 1099 Tax Form Printable Forms Free Online, Key dates for filing 1099s in 2024. If you sold your main home.

For 2020 Taxes This Would Be.

In addition to filing with the irs, a recipient copy must be.

This Form Is Used To Report Dividend Income From Stocks Or Mutual Funds.

Select search, enter sale of home,.